A balloon note or balloon loan or balloon mortgage loan is a very special type of loan plan in which you just need to make the periodic installments consisting of the interest rate only and when the loan is matured or expired, you end up with a huge amount of loan capital that you are required to pay in a short period of time.

Brief Description of Balloon Note:

There are hundreds of types of loans and mortgage loan plans and balloon loans are one of them. When we talk about a simple loan plan it includes you getting a loan payment from the bank with a specific interest rate for a period of time. You are then required to make periodic installments i.e. every month or twice a year in order to pay off your debt and when the duration ends, your entire debt is paid off where on the other hand when we talk about a balloon note, it’s completely different here. When you get a balloon note, you get it with a small interest rate and you only need to make the monthly installments consisting of the interest rate only and when the loan period ends, you will need to pay the entire amount of loan capital in one installment.

Advantages and Disadvantages of Balloon Note:

There are many advantages and disadvantages of the balloon loan or balloon mortgage and some of them are important to discuss here. The first benefit of using balloon notes is that with this type of loan, there is a lesser liability on the debtor as he can pay off his debt quicker with just one final payment. Also when you get a balloon loan, you don’t need to make the loan payments on a specific date but you can make the payments whenever you want. Another huge advantage of this type of loan is the lowest interest rate as compared to other types of loans and mortgages. In the end, if you want, you can also refinance the balloon loan with a second mortgage loan and if you agree to a 10-year balloon loan, you can also extend it up to 30 years without increasing the interest rate.

The balloon note also includes some setbacks and disadvantages and it includes the most common and important disadvantage is that at the end of the loan payments, you end up with a huge amount in your debt and you have to pay it in a short period of time and this can create problems for you. It is very common that when debtors can’t pay off the final payment of their balloon note, there is nothing left for them to do but foreclosure or bankruptcy. Also if you want to change the balloon loan into a normal loan at any point, you will have to agree with a much higher interest rate as well. Also, many people think of this factor as a benefit but in reality, it’s a setback and here we are talking about the short upfront payment because that means you will end up with a huge debt amount at the end of the loan which is much bigger than other loan plans.

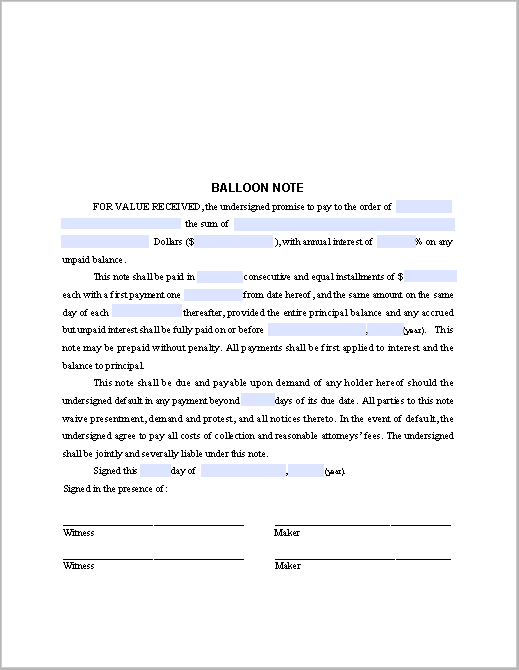

Here is a preview of a Free Sample Balloon Note in fill-able PDF Format,

Here is the download link for this Balloon Note,